Article Directory

Alright, buckle up, folks! We're diving deep into something that, on the surface, might seem like just another ETF update, but trust me, it's a signpost pointing directly to the future. We're talking about the Vanguard Total Stock Market ETF (VTI), and why its "Moderate Buy" rating is whispering of a technological revolution brewing beneath the surface.

Now, I know what you might be thinking: "Dr. Thorne, an ETF? Really? That's your idea of groundbreaking?" But hear me out, because this isn't just about the VTI itself; it's about what it represents. It's about the collective faith, the capital pouring into the very engines that are driving us toward a fundamentally different world.

The Undercurrent of Innovation

Let's break it down. VTI is a fund that gives you a slice of the entire U.S. stock market. That means you're not just betting on one horse; you're betting on the whole damn race. And right now, that race is being fueled by technological innovation. I mean, look at VTI's top holdings: Nvidia, Microsoft, Apple. These aren't just companies; they're the architects of our digital future. What does that tell you?

The fact that VTI is showing positive net flows – $382 million one week, $553 million the next – even with some minor dips in daily performance, tells me investors aren't just chasing short-term gains. They’re betting on the long game, on the transformative power of these companies to reshape industries, societies, and lives. And let’s be real, who wouldn’t want a piece of that pie? It's not just about returns; it's about participating in the future being built right now.

And that "Moderate Buy" rating? It's almost too modest! According to TipRanks, the average price target implies a potential upside of almost 18%. That's not just good; that's a rocket ship about to launch! It reminds me of when everyone was cautiously optimistic about the internet in the early 90s. We knew something big was coming, but we couldn't quite grasp the scale of the change. This feels the same, doesn't it? What if the analysts are underestimating the potential? What if this is just the beginning of an exponential growth curve?

Now, I know, I know – market concentration is a concern. Someone wrote that VTI's total market exposure is "inferior to its returns". But I see it differently. This concentration isn't a weakness; it's a strength. It shows where the real innovation is happening, where the capital is flowing, and where the future is being forged. The big players are big for a reason: they're the ones pushing the boundaries, the ones investing in the kind of moonshot projects that will define the next century.

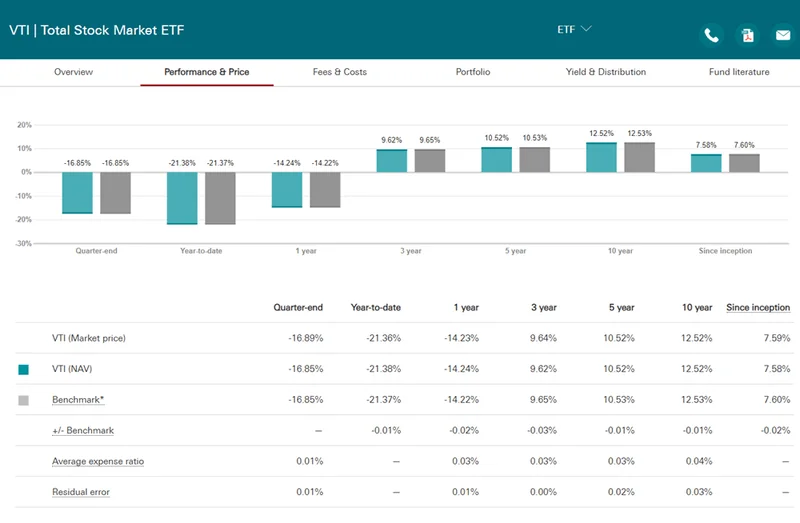

Here's where it gets really exciting. The fund's technical snapshot shows it trading above its 50-day moving average. Now, for those of you who aren't glued to trading charts (and let's be honest, who has the time?), this is a bullish signal. It suggests that the upward trend is likely to continue, that the momentum is on our side. This isn't just about numbers; it’s about the underlying energy, the collective belief that we're on the cusp of something extraordinary.

And speaking of extraordinary, let’s take a peek at the holdings with the highest upside potential: BioAtla, Sangamo Biosciences, Cibus, FibroBiologics, and NRX Pharmaceuticals. What do these companies have in common? They're all in the business of life extension, biotechnology, and cutting-edge medicine. Are you seeing the pattern here? The VTI isn't just about tech; it's about the convergence of technology and biology, the quest to not only make our lives easier but also longer and healthier. This is the kind of stuff that makes me, honestly, just want to sit back in my chair and stare at the ceiling thinking about how incredible the future is going to be.

But, and there's always a "but," we also need to be mindful of the ethical implications. As technology accelerates, as we gain the power to manipulate life itself, we need to ask ourselves: Are we ready for this? Are we prepared for the societal shifts, the moral dilemmas, that will inevitably arise? I think that we need to be prepared to have some serious conversations about the kind of future we want to create.

The Accelerating Singularity

It feels like we're on the cusp of a technological singularity. Remember when the printing press was invented? It democratized knowledge, sparked the Renaissance, and changed the course of human history. What we are seeing now with VTI and the tech it represents is that same kind of paradigm shift, but on steroids. It's not just about information; it's about energy, biology, and the very fabric of reality.

So, is VTI a "sure thing"? Of course not. There are always risks, always uncertainties. But what it does represent is a powerful signal, a flashing neon sign pointing toward a future that is being built right now, a future that is more exciting, more transformative, and more full of potential than anything we've ever seen before. According to VTI ETF Daily Update: What Investors Need to Know – 11/6/2025, keeping up with daily updates can help investors stay informed.