Article Directory

The Fed's Bold Move: Are We Ready for Sub-4% Rates?

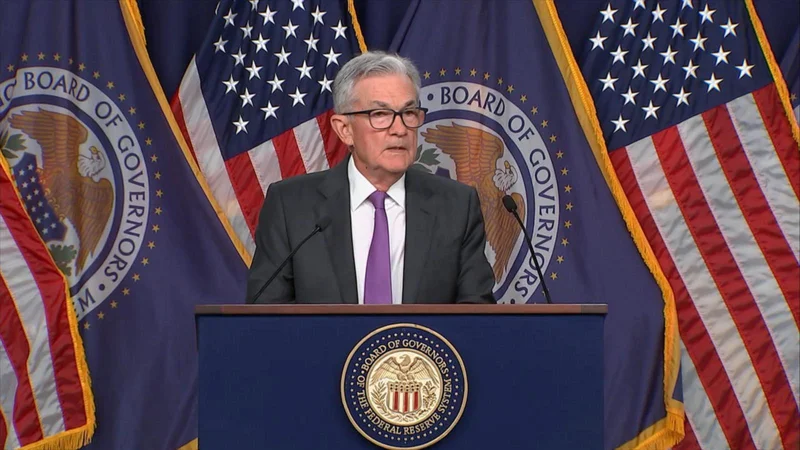

Okay, everyone, buckle up. Because what happened today at the Federal Reserve isn't just another decimal point shift—it's a potential seismic tremor in the economic landscape. They cut rates. Again. And while the blackout of government data throws a wrench into the usual analysis, the implications are crystal clear, even through the fog.

The Fed is walking a tightrope, right? On one side, you've got the specter of a slowing labor market. Powell himself hinted at this last month, a growing concern about the "downside risks to employment." On the other side, inflation—that beast we've been wrestling with for what feels like forever—seems to be, dare I say it, cooling off. The Consumer Price Index came in softer than expected, a welcome surprise. It's like the Fed is trying to fine-tune a hypercar engine while driving at top speed, and honestly, it's exhilarating to watch.

I'm seeing some headlines questioning the move, worrying about long-term effects. But here's what they're missing: this isn't just about numbers; it's about confidence. It's about injecting some much-needed optimism into the market, giving businesses the green light to invest, expand, and hire. Think of it like this: lower rates are the fertilizer, and the economy is the seed. Will it guarantee a bountiful harvest? Of course not. But it sure as heck increases the odds.

And what does this mean for you, the everyday person? Well, for starters, those credit card bills might get a little less painful. Home equity lines of credit? Same deal. And while mortgage rates have already been trending downward in anticipation of this move, a sustained period of lower rates could make that dream of owning a home a little more attainable. It's not a magic bullet, but every little bit helps, right?

Now, let's talk about the elephant in the room: the government shutdown and the data blackout. It's like trying to navigate a ship in a dense fog with a broken radar. Powell acknowledged the issue, but he also assured us that the Fed has access to alternative data sources. But is it enough? Can they truly make informed decisions without the full picture? That's the million-dollar question. It would be like a doctor diagnosing a patient based on symptoms alone, without the benefit of X-rays or blood tests. Risky, to say the least.

It's interesting that the Bank Policy Institute (BPI) released a statement yesterday about changes to the Large Financial Institution (LFI) rating system. The BPI wants regulators to adopt commensurate changes to the CAMELS rating framework reflecting similarly rigorous and reliable standards. I have to wonder if these changes are being pushed due to the Fed's rate cuts. For more information, read the BPI Statement on Federal Reserve Changes to LFI Rating System.

But consider this: what if this is more than just a tactical move? What if it's a signal of a fundamental shift in the Fed's thinking? What if they're willing to tolerate slightly higher inflation in exchange for a stronger labor market and sustained economic growth? That would be a paradigm shift, a complete rethinking of the central bank's role in the economy.

This is where things get really interesting. Because if the Fed is truly embracing a more holistic approach to monetary policy, it could have profound implications for the future. Imagine a world where economic policy is driven not just by numbers, but by a genuine concern for the well-being of everyday people. It's a utopian vision, I know. But it's a vision worth striving for.

Now, a word of caution. With great power comes great responsibility, as they say. Lower rates can fuel asset bubbles, encourage reckless borrowing, and exacerbate inequality. It's crucial that we proceed with caution, that we don't get carried away by the euphoria. We need to be mindful of the potential risks and take steps to mitigate them.

The Dawn of a New Economic Era?

Because honestly, seeing the Fed take this step? It makes me wonder if we're on the cusp of something truly transformative. Are we entering an era where economic policy is driven by human needs, not just cold, hard numbers? Only time will tell. But one thing's for sure: the ride is going to be fascinating.