Article Directory

On October 30, the market will receive quarterly results from two of its most-watched crypto proxies: MicroStrategy (MSTR) and Coinbase (COIN). On the surface, it’s a simple horse race. Both stocks offer exposure to the digital asset space and have delivered staggering returns for those who timed their entries correctly. But to lump them together is a category error of the highest order.

These aren’t just two different companies. They represent two fundamentally different theses on the future of cryptocurrency as a financial asset class. One is a highly leveraged, single-asset bet that has transformed a legacy software business into a de facto Bitcoin holding company. The other is a bet on the infrastructure—the plumbing, the wiring, the tollbooths—of the entire crypto economy. As their earnings reports approach, the real question isn’t simply MSTR vs. COIN: Which Crypto Stock Is a Better Buy Ahead of Earnings?, but which investment philosophy you’re actually buying into. The distinction is critical, and the data reveals a stark contrast in what investors are underwriting.

The Bitcoin Zealot vs. The Crypto Plumber

MicroStrategy’s business model has become a fascinating case study in corporate strategy, or perhaps corporate obsession. The company’s primary operation is providing enterprise analytics software, a business that generates a steady, if unexciting, stream of revenue. Wall Street expects sales of $116.65 million for the quarter (a negligible increase from the prior year). However, this core business has been completely overshadowed by its secondary, and now primary, function: acquiring and holding Bitcoin.

The company's P&L is a testament to this duality. Because MSTR must report unrealized gains or losses on its BTC holdings as part of its operating expenses, its quarterly earnings figures are subject to wild, almost meaningless, swings. The forecast is for a diluted loss of $0.10 per share, a vast improvement from last year's $1.72 loss, but this number is almost entirely a function of the BTC price, not operational excellence. And this is the part of the report that I find genuinely puzzling from an analytical standpoint: the company’s track record for meeting expectations is abysmal, having surpassed analyst estimates in only two of the past eight quarters. Operationally, it is profoundly unpredictable.

MSTR just keeps buying. A recent filing shows it raised another $43.4 million to acquire 390 more Bitcoin, bringing its total hoard to approximately 640,000—to be more exact, 640,808 BTC. This isn't a company that uses an asset to enhance its business; this is a company whose business is now the asset.

Coinbase, on the other hand, is the plumber. It runs one of the world’s largest crypto exchanges, acting as a broker, custodian, and market maker. Its performance is certainly correlated with crypto prices, as higher prices drive trading volume and user engagement. But its revenue streams are far more diversified. It earns transaction fees, service charges on its stablecoin (USDC), and yield from staking activities. It is a bet on activity, not just price.

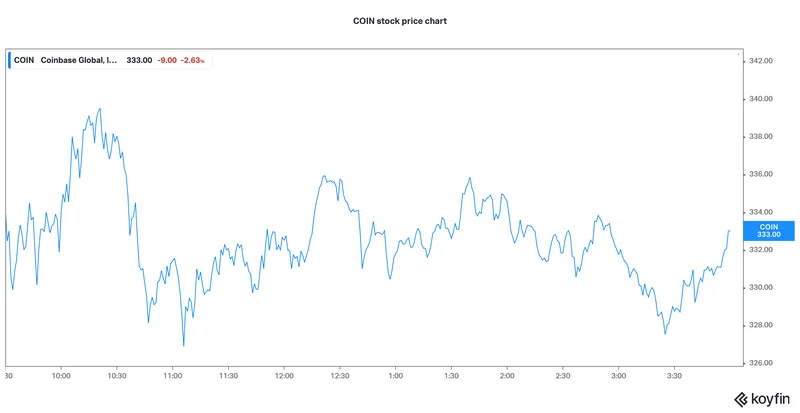

The numbers reflect a more robust operational picture. Analysts expect Coinbase to report earnings per share of $1.15 on $1.80 billion in sales, a significant jump from the $0.28 EPS and $1.21 billion in sales from the same period last year. Crucially, Coinbase has exceeded consensus estimates in five of the past eight quarters. Unlike MSTR, it has a demonstrated history of outperforming expectations. Its recent partnership with Citigroup to facilitate fiat deposits for institutional clients is another data point suggesting it’s maturing into a core piece of financial infrastructure, not just a speculative vehicle.

A Discrepancy in Market Perception

So, we have one company (MSTR) with a weak operational track record whose fate is lashed to a single volatile asset. We have another (COIN) with a stronger, more diversified business model and a better history of execution. Logically, you would expect analysts to favor the more stable operator.

You would be wrong.

This is where the narrative disconnects from the data. According to TipRanks’ comparison tool, MSTR currently holds a “Strong Buy” consensus rating with a staggering average upside potential of 89.8% over the next year. TD Cowen’s analyst, for instance, has a $620 price target, implying a 117.8% upside, based on the projection that MSTR will hold over 4% of the total Bitcoin supply by 2027.

Meanwhile, a recent JPMorgan upgrade moved the COIN stock price to a Buy, but with a price target implying a much more modest 13.7% upside. The thesis here is grounded in business fundamentals: the potential launch of a token for its Layer 2 blockchain and higher yields from its subscription services. These are catalysts rooted in the company’s operations.

What explains this massive discrepancy? Why is the riskier, less predictable entity seen as having multiples more upside? The answer is that analysts aren't really analyzing MicroStrategy, the software company, at all.

The MSTR stock is a financial instrument. It’s a way for traditional equity investors to get leveraged exposure to the Bitcoin price without having to directly own the asset. The analyst ratings for MSTR are, in effect, simply bullish forecasts for BTC. They are not an assessment of Michael Saylor’s ability to sell enterprise software. The company is a container, and the only thing that matters is what’s inside. It’s less like buying stock in Ford and more like buying a warehouse certificate for a massive pile of aluminum, where the value of the warehouse itself is a rounding error.

This isn’t necessarily a flawed strategy, but it’s crucial to understand what it is. A bet on MSTR is a pure, unadulterated, and leveraged bet on one thing and one thing only. A bet on COIN is a broader wager on the continued growth, adoption, and transaction volume of the entire digital asset ecosystem. One is a sniper rifle aimed at a single target; the other is a shotgun aimed at the whole barn.

You're Buying a Thesis, Not a Company

When you strip away the noise, the choice becomes clear. Investing in MicroStrategy is not an investment in a business in the traditional sense. It's an expression of a macroeconomic view: that the price of Bitcoin is going to appreciate significantly, and you want the most aggressive, leveraged vehicle available in the public markets to ride that wave. The company's financials are secondary; its operational performance is almost irrelevant.

Investing in Coinbase is a different proposition. It's a bet on the maturation of an industry. You're underwriting the belief that, regardless of whether BTC, ETH, or some other token dominates, people will need a place to buy, sell, and store these assets. You're buying the infrastructure. The potential upside may appear lower, but it’s built on a foundation of operational growth and market integration.

Conflating these two stocks is a fundamental analytical error. Before their earnings reports land, investors should ask themselves a simple question: Am I trying to buy a business, or am I just trying to buy Bitcoin with a stock ticker? The answer will tell you everything you need to know.