Article Directory

Every piece of technology you love, every device that feels like magic in your hands, has a physical soul. It’s not code; it’s not the cloud. It’s metal. Specifically, a group of obscure elements called rare earths, and for decades, we’ve outsourced the mining and processing of that soul to a single geopolitical rival. We built our entire digital and green-energy future on a foundation we didn’t own, and now, the landlord is threatening to change the locks.

Beijing is tightening the spigot. With new export controls on rare-earth elements and the equipment needed to process them, a shudder is running through the global economy. Goldman Sachs warns of a potential $150 billion hit to global output. This isn't some abstract trade dispute; it's a direct threat to the production of everything from the F-35 fighter jet to the electric vehicle in your neighbor's driveway.

In the midst of this geopolitical storm, a single location in the California desert has become one of the most important pieces of land in the Western world: the Mountain Pass mine, home to MP Materials. And what’s happening there isn’t just about digging rocks out of the ground. It’s a fundamental shift in how we think about technology, security, and the very building blocks of the 21st century.

The Geopolitical Chessboard Gets Physical

For years, we’ve talked about supply chains in abstract terms. But let's be brutally clear about what this means. China controls roughly 70% of rare-earth mining, 92% of the refining, and a staggering 98% of the manufacturing of the high-powered magnets that use them. This is the industrial equivalent of letting one country on the other side of the world control all the world’s oil refineries and gas stations. It’s a strategic vulnerability of breathtaking scale.

The key ingredients here are elements like neodymium and praseodymium—let’s just call it NdPr. In simpler terms, this is the secret sauce for the most powerful and efficient permanent magnets on Earth. These aren't the clunky things holding your kid's art to the refrigerator. These are the hyper-efficient hearts of modern technology, spinning the motors in EVs, guiding drones, and powering the speakers in your smartphone. Without a secure supply of NdPr, our most advanced industries grind to a halt.

For a long time, MP Materials was an interesting but speculative bet on reshoring this capability, though some now see 1 Incredible Reason to Buy MP Materials' Stock in November. It was a lone American miner trying to compete against a state-subsidized behemoth. Its stock has seen a meteoric rise this year, up 340%, leading many short-term thinkers to scream "overvalued!" They point to its high price-to-sales multiple and its current unprofitability. But honestly, are they even asking the right question? Is this still a company you can value with a standard spreadsheet?

Washington's Unprecedented Insurance Policy

Here’s where the story pivots from a simple business case to a chapter in our national history. In July, the U.S. Department of Defense didn't just give MP Materials a grant. It became its biggest shareholder with a $400 million investment. When I first read the details of that deal, I honestly just sat back in my chair, speechless. This wasn't just a vote of confidence; it was a fundamental reclassification of a public company into a strategic national asset.

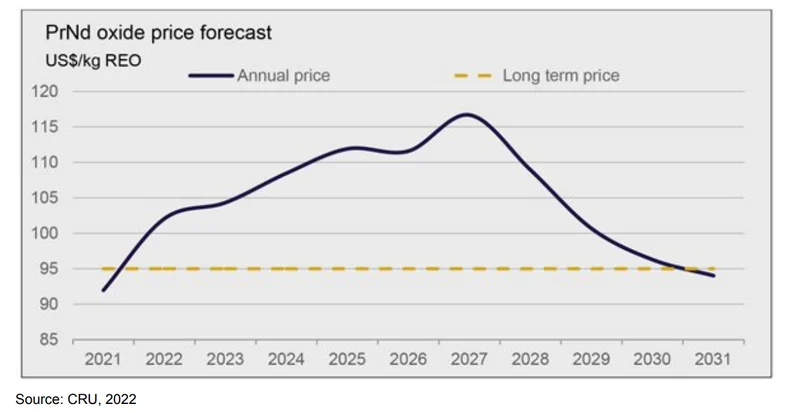

The DoD went even further. It committed to a 10-year price floor for MP’s NdPr oxide and guaranteed the purchase of 100% of the output from the company’s next-generation magnet factory. This is an almost unheard-of move in the free market—the government has essentially removed all commodity price risk and all demand risk from the company's most critical expansion plans, which is a breathtaking intervention that gives MP a runway to build and scale that no private-sector competitor could ever dream of.

What does this really mean for us, for the future of American innovation? It means that for the first time in a generation, there's a concerted, state-backed effort to rebuild a foundational industry from the ground up. This reminds me of the massive government investments that kickstarted the semiconductor industry or even the Apollo program. We, as a nation, decided that leadership in a critical technology was non-negotiable, and we put our full economic and political weight behind it. We're seeing that happen again, not with microchips or rockets, but with the very atoms that make them possible.

Of course, with this kind of power comes immense responsibility. We have to ensure that rebuilding this industry on American soil is done to the highest environmental and ethical standards, setting a new global benchmark that stands in stark contrast to the often-opaque practices elsewhere. This is our chance to prove that industrial strength doesn't have to come at the cost of our principles. But the signal has been sent. The financial metrics of MP Materials in the short term almost don’t matter. You’re not investing in a mining company’s quarterly earnings; you’re witnessing the birth of a secure, domestic supply chain for the technologies that will define our future.

This Isn't About a Stock, It's About a Foundation

Let’s step back and see the big picture. The debate over MP Materials' stock valuation completely misses the point. This is no longer just a company; it's a piece of critical infrastructure. It’s a national project. The DoD's investment is a declaration that the physical components of our technological future are now a matter of national security. We are finally treating the elements that power our world with the same strategic importance as the energy that fuels our homes. This is the bedrock on which the next generation of American innovation—from artificial intelligence to clean energy to autonomous everything—will be built. And it's happening right now, in a quiet patch of the California desert.