Article Directory

Is VGT's 'Moderate Buy' Rating a Ticking Time Bomb?

There’s a strange stillness in the data surrounding the Vanguard Information Technology ETF (VGT). As of yesterday, October 27, 2025, the fund closed at $786.40. The consensus price target from the collection of analysts who spend their days modeling these things? Exactly $786.40.

This isn’t a forecast. It’s a mirror.

When a price target perfectly matches the current price, it signals one of two things: either the market has achieved a moment of perfect, rational pricing, or—far more likely—the analysts have collectively thrown up their hands. It’s a statistical shrug, a non-answer dressed up as a data point. And this is the part of the data that I find genuinely unsettling. This isn't an analysis; it's an abdication of one. It’s the quiet before a storm, and my job is to look at the instruments to see what’s really forming on the horizon.

The official Wall Street weather report for VGT is a "Moderate Buy." It’s a lukewarm, non-committal term that sounds reassuring. It suggests cautious optimism. But when you place that placid rating next to the fund’s underlying metrics, the picture becomes deeply incoherent. This isn't just a discrepancy; it's a contradiction that should be keeping investors up at night.

The Valuation Paradox

Let’s start with the most glaring number: the price-to-earnings (P/E) ratio. VGT is currently trading at a P/E of around 35—to be more exact, 34.55. For context, the historical average for the S&P 500 hovers somewhere between 15 and 20. A P/E of 34.55 isn't just optimistic; it’s priced for perfection. It implies that the underlying companies, the tech titans that constitute this ETF, are expected to deliver explosive, near-flawless earnings growth for the foreseeable future.

This is where the "Moderate Buy" rating begins to look less like an endorsement and more like a hedge. A fund with this kind of valuation shouldn't warrant a "moderate" anything. It should either be a screaming "Strong Buy" from analysts who are utterly convinced that a new technological paradigm will justify these multiples, or it should be slapped with a "Sell" rating by anyone who believes in historical gravity.

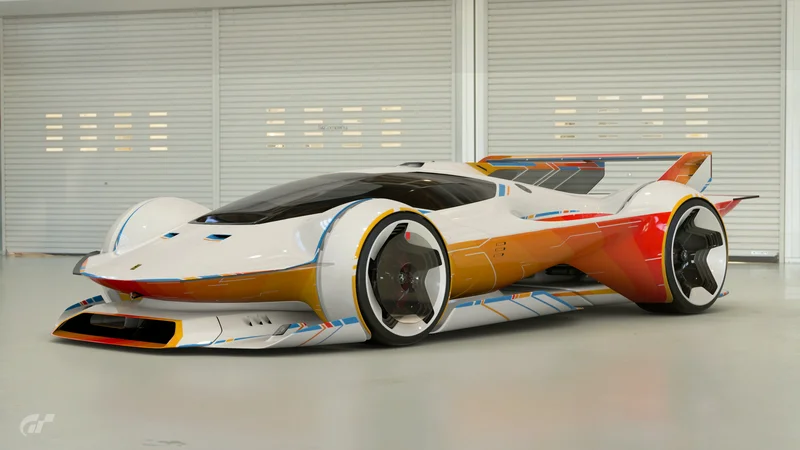

A "Moderate Buy" is an attempt to have it both ways. It's like looking at a vehicle priced like a Ferrari and giving it the performance review of a reliable sedan. The rating is a failure to match the risk profile. Imagine an analyst staring at their terminal, the blinking cursor hovering over their rating submission. They see the momentum, the seemingly unstoppable rise of Big Tech. But they also see the valuation, stretched taut like a rubber band. They can’t bring themselves to bet against the trend, but they can’t logically endorse the price. The result? "Moderate Buy." It’s the path of least professional resistance.

But what does this mean for the investor? It means the consensus is offering no real guidance. It’s a sign that the experts are just as uncertain as everyone else, but are unwilling to state it so plainly. The question isn't just whether the growth will materialize. The real question is: what happens if it's merely good instead of spectacular?

The Income Vacuum

If the valuation side of the equation is built on hope, the income side is built on, well, nothing. The fund’s dividend yield is a paltry 0.39% (a figure that barely registers against even the most benign inflation). This isn't a criticism; it’s a simple statement of fact. Tech companies, particularly those in a high-growth phase, famously reinvest their earnings rather than paying them out to shareholders. The investment thesis for VGT is, and always has been, about capital appreciation.

But when you combine a near-zero yield with a P/E ratio north of 30, the investor’s risk profile changes dramatically. There is no safety net. You are not being paid to wait. Your entire return is dependent on the fund’s price continuing its upward march. The low yield acts as a massive amplifier for the valuation risk. If the growth narrative falters for even a quarter or two, there is no dividend cushion to soften the blow. The floor is a long way down.

This creates a precarious situation. The entire structure is supported by a single pillar: relentless, forward-moving sentiment. The "Moderate Buy" rating and the perfectly-aligned price target suggest that sentiment is currently in a state of suspended animation. The market is holding its breath, waiting for the next catalyst. But in a structure this fragile, what happens when it finally exhales? Is the current price a plateau before the next climb, or is it the peak of a mountain from which the only path is down?

A Calculation of Complacency

When you strip away the noise, the story of VGT today is one of profound complacency. The "Moderate Buy" rating isn't a signal of conviction; it’s a symptom of paralysis. Analysts are caught between the gravitational pull of historical valuation metrics and the irresistible force of market momentum. Their solution is to issue a rating that effectively says nothing at all, while setting a price target that simply validates the present moment.

This isn't analysis. It's a surrender to the trend. The ticking time bomb isn't necessarily an imminent crash, but the slow erosion of risk awareness. The market has priced VGT for a perfect future, and the analysts who are supposed to be providing a sober second opinion are simply nodding along. The real danger is that when everyone agrees, nobody is thinking critically. And in investing, that’s when you’re most vulnerable.