Article Directory

So, Zcash is back.

Just when you thought 2025 couldn't get any dumber, the crypto market decided to resurrect a ghost from 2016. Zcash (ZEC), the coin that was supposed to be "encrypted Bitcoin," the digital cash of the cypherpunk dream, has clawed its way out of the digital graveyard. We’re talking a 380% surge in a month, a market cap ballooning to nearly $6 billion, and a spot back in the top 25.

I had to check my calendar to make sure I hadn't time-traveled. Zcash was a relic. A footnote. It was the crypto equivalent of a dusty vinyl record in an age of AI-generated Spotify playlists. And now, suddenly, it’s the hottest ticket in town.

Let’s be real. Most of the people piling into this thing probably think "zk-SNARK" is a new energy drink. They see a chart going vertical, they hear some noise on X from the usual suspects like Arthur Hayes and Barry Silbert, and they jump in. It’s the classic crypto playbook, and frankly, it’s getting old. But is that all that’s happening here? Is this just another speculative fever dream, or is there something real stirring beneath the surface?

A Forgotten Philosophy Gets a New Price Tag

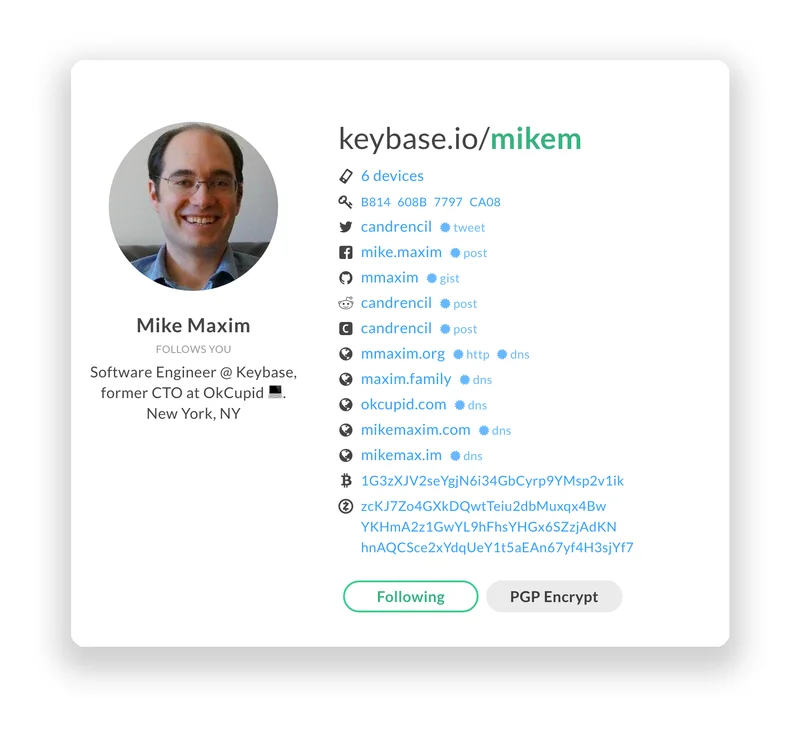

Remember privacy? It used to be a thing. Before every transaction was logged on a public ledger for chain-analysis firms to pick apart, the idea was to build digital cash. You know, like actual cash—fungible, untraceable, sovereign. That was the whole point. Zcash was born from that ethos, a fork of Bitcoin that bolted on zero-knowledge proofs to let you transact in the dark.

For years, nobody cared. The market chased DeFi yields, meme coins, and whatever the hell "restaking" is supposed to be. Privacy coins like Zcash and Monero got delisted from exchanges, branded as tools for criminals, and left for dead. They were inconvenient. They didn't play ball with the regulators who want a backdoor into every wallet.

And now? The world is catching up to the paranoia. With the UK pushing digital IDs and the EU tightening the screws with MiCA, the idea of financial surveillance isn't a tinfoil-hat conspiracy anymore. It’s the Tuesday morning compliance meeting. Suddenly, the ability to send money without broadcasting it to the entire world doesn't seem so radical. It seems… necessary.

This renewed focus on privacy is the only legitimate pillar holding up this ZEC rally. The "shielded supply"—the amount of ZEC tucked away in private addresses—has hit 4.5 million. That's not just a number on a screen. It's an active choice. People are taking their coins off exchanges and pulling them into the network's private pools. This is a bad thing for onchain liquidity. No, 'bad' isn't the right word—it's a terrifying thing for price discovery, but it’s a powerful signal of user conviction. It’s like watching people pull their money out of the banking system and stuff it under the mattress, except the mattress is an encrypted, decentralized network. The more ZEC that goes into this financial black box, the bigger the anonymity set gets, strengthening the privacy for everyone involved.

But does this growing adoption justify a 7x price surge in a matter of weeks? Or is it just a convenient narrative to slap onto a market rotation?

Don't Believe the Hype Machine

Here’s where the story gets messy. For every thoughtful argument about digital sovereignty, there are ten idiots on social media screaming about an upcoming "halving." Except, there is no halving. The last one was in November 2024. The next one isn't until 2028. Coincodex had to publicly correct this, but the myth persists because, well, people would rather believe a simple, bullish lie than a complex truth.

This is the part that drives me nuts. It's like watching a magic trick where you can see all the wires, but the audience is still cheering. You've got the big-name influencers whispering sweet nothings about $10,000 price targets. You've got a fake scarcity narrative driving retail FOMO. And offcourse, you have the market rotators, traders bored with Bitcoin and Ethereum's sideways chop, looking for the next shiny object to gamble on. It ain't a renaissance; it’s a casino.

And what about the institutions? Forget it. They won't touch this stuff with a ten-foot pole. Their compliance departments would have a collective aneurysm. Many exchanges still block or restrict shielded transactions, effectively neutering Zcash's entire reason for existing. Even the news that Unichain L2 adds support for non-EVM assets DOGE, XRP and Zcash comes with a giant warning label: "Don't send these to centralized exchanges." So what are you supposed to do with it, exactly?

The whole thing feels incredibly fragile. It’s a comeback story built on a potent mix of genuine idealism, technical progress, and a whole lot of bullshit. The developers are making real strides with a new zero-knowledge architecture, and the growth in shielded supply is undeniable. But the price action feels disconnected from that reality. I’m watching the daily chart, and reports like the Zcash Technical Analysis Report 30 October, 2025 are already calling for a correction down to the $268 level after it got rejected hard at $355. It’s forming bearish patterns that suggest this rocket ship is running out of fuel. And when the retail tourists who bought the halving myth get burned...

It's a Beautiful, Doomed Idea

Look, I want to believe. I really do. The cypherpunk in me loves the idea of a truly private digital currency thriving in an era of encroaching surveillance. The resilience of Zcash—a project from 2016 that’s still shipping code and maintaining a network—is genuinely impressive. It's a testament to the power of an idea.

But the market doesn't care about ideas. It cares about liquidity, narratives, and momentum. And right now, Zcash's momentum is fueled by a dangerous cocktail of misinformation and speculation. The privacy narrative is real and more important than ever, but it’s being used as a cover for a classic crypto pump. This rally might be a sign that privacy is making a comeback, or it might just be the loudest gasp of a dying ideal before it’s swallowed whole by a regulated, sanitized, and utterly boring financial system. I'm just not sure which one it is yet.