Article Directory

The Unsettling Math Behind ChainOpera AI’s $4 Billion Valuation

At first glance, the story of ChainOpera AI ($COAI) is the kind of narrative that defines a crypto bull run. A project emerges at the perfect intersection of two white-hot trends—Artificial Intelligence and Web3—and proceeds to print staggering numbers. A Fully Diluted Valuation (FDV) cresting $4 billion, a 30-day price surge of over 2,200%, and daily trading volumes that briefly eclipsed giants like Solana and BNB. The project’s own commissioned materials paint a picture of strategic genius: a flawless launch timed with the AI market’s peak excitement, a savvy choice to build on the surging BNB Smart Chain, and a brilliant co-listing strategy that created a traffic "resonance effect."

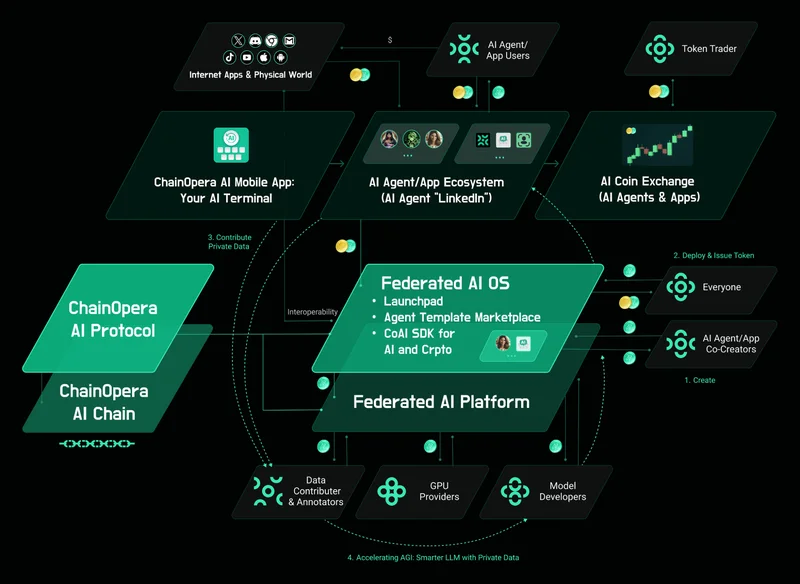

This is the story you are meant to hear. It’s a clean, compelling narrative of product-market fit meeting perfect execution. The company claims its success is the result of a "full-stack AI infrastructure" and an operational ecosystem, a stark contrast to the vaporware that so often plagues this industry. They point to 3 million AI users and a seamless funnel that converts them into token holders, solving a persistent Web3 pain point. And I will admit, the timing was impeccable. Launching into a market pre-educated by other AI projects and supercharged by a frenzy in perpetual futures trading is textbook opportunism. But this is the part of the analysis where I find the official narrative genuinely puzzling, because the story being told in the marketing materials and the story being told by the on-chain ledger are two fundamentally different tales.

The official version, laid out in sponsored posts like The Secret Behind ChainOpera AI’s Explosive Success: Strategic Cycle Timing and a Fully Diluted Valuation Beyond $4 Billion, focuses entirely on external correlations. The price of BNB was soaring. Perps trading volume was at a peak. A stablecoin project, $XPL, happened to launch on the same day. These are presented as causal factors for ChainOpera’s success. But what does this narrative conspicuously omit? Any deep analysis of the token’s own internal structure. And when we turn our attention from the market’s weather patterns to the architecture of the house itself, we find a foundation that looks alarmingly fragile.

A Tale of Two Data Sets

When we move from marketing copy to the blockchain, a different, less flattering picture emerges. The core discrepancy lies in the token distribution. According to on-chain analysis, the ownership of $COAI is extraordinarily centralized. Data from blockchain analytics firms like Bubblemaps has been stark: about ten wallets control the supply—to be more exact, a staggering 87.9% of all $COAI tokens are held by just ten addresses. One report went further, claiming a single entity was behind half of the top-earning wallets.

Let’s put this in perspective. This isn’t a decentralized project. This is the digital equivalent of a publicly traded company where the board of directors and a few of their friends own nearly 90% of the floating stock. The public, the retail traders caught up in the 1,308% surge in social media mentions, aren't participants in a new financial ecosystem. They are guests playing at the high-roller table, and the house holds almost all the chips. How can a project claim to be building a decentralized AI network when its own governance and value are so profoundly centralized? And what does that concentration of ownership enable?

It enables the very volatility that gets touted as success. A 512% price jump in 24 hours isn't a sign of organic demand; it’s a symptom of a shallow market where a few key players can move the price with relative ease. The massive volume numbers (at one point hitting $481 million in 24 hours) are equally misleading. A significant portion of this activity was concentrated in the perpetual futures market, not in spot buying for long-term utility. This was a speculators’ paradise, fueled by record-high open interest of $167 million and a weighted funding rate that showed traders were paying a premium to bet on even higher prices. The subsequent $17 million in short liquidations wasn’t a byproduct of the rally; it was the fuel.

This structure creates a perfectly engineered echo chamber. The concentrated holders can influence the price, which generates hype and media attention. This hype draws in retail traders, who add leverage and liquidity, further amplifying the price moves and liquidating anyone betting against it. The social sentiment data from LunarCrush confirms this isn't about the technology; the top themes driving conversation were "trading opportunity" and "exchange listings." The product itself was a distant third. It’s a feedback loop of pure speculation, and it’s one we’ve seen countless times before.

The comparisons drawn by skeptical analysts and questions like Why Are Experts Calling ChainOpera AI (COAI) a Scam? aren't just casual insults; they are pattern recognition. The playbook is becoming depressingly familiar: launch with a powerful narrative, secure listings on major centralized exchanges that lend an air of legitimacy, and leverage a highly concentrated token supply to engineer a parabolic price chart that attracts exit liquidity. Is this a masterclass in market timing, or is it a masterclass in market manipulation hiding in plain sight?

A Perfectly Calibrated Illusion

When you strip away the narrative of AI synergy and bull market tailwinds, you are left with a set of cold, hard numbers. And those numbers suggest that ChainOpera AI’s explosive rise has less to do with its product and more to do with a tokenomic structure that is optimized for volatility and control. The project may well have a functional AI terminal and a growing user base, but the value proposition of its token appears to be completely detached from those fundamentals. Its success seems almost entirely dependent on a feedback loop of speculative leverage, driven by a handful of wallets that hold the power to dictate its trajectory. The real question isn't whether ChainOpera AI can continue its ascent, but rather what happens when the handful of entities controlling 88% of the supply decide the party is over.